What You Should Know About Surprise Billing to Help Improve Your Patient’s Experience

There is opportunity for hospitals and other healthcare providers in the No Surprises Act. When we read about more regulations, our thoughts often race to our questions: what is it, how we will manage, we are already buried in rules and regulations . . . and on and on we go.

The No Surprises Act went into effect January 1, 2022, to protect patients against a balance bill. This is not news to you if you have been in healthcare more than a month. The new rules include protection for many patients who do not receive healthcare coverage through Medicare, Medicaid, and other federal programs that already protect the consumer against high medical bills. The new rules apply to group and individual health plans along with self-pay patients and address two areas: 1) Federal regulation of surprise billing; and 2) Patient transparency requirements. To clarify, this does not replace state regulations on the subject.

Issues covered under the No Surprises Act are associated with patients receiving a surprise bill, which is sometimes referred to as a “balance bill” (e.g., the balance of remaining charges not covered by insurance for an out-of-network (OON) provider). A surprise bill or balance bill is by definition a bill the patient did not expect. It can be generated in any number of scenarios, such as an emergency room visit when the patient is out of town, or a visit by the patient to an in-network hospital for surgery when your hospital is in-network but your anesthesiologist or other ancillary provider is OON. Also, this may apply when your facility has provider-based billing designation (e.g., hospital outpatient clinics and/or physician offices are considered a department of the hospital) and the managed care contracts are not aligned between hospital and clinic/physician.

The same month that the No Surprises Act went into effect, the Office of Inspector General (OIG) added “Hospital’s Compliance with the Provider Relief Fund Balance Billing Requirement for Out of Network (OON) Patients” to the OIG active workplan items. Audits are forthcoming and if you received Provider Relief Funds (PRF), you are surely guaranteed a seat at the table. It is too early to tell what that looks like but it may be similar to previous RAC audit processes.

However, we do know what they will audit. The objective for OIG is to perform audits to determine compliance for hospitals/providers that “received PRF payments and attested to the associated terms and conditions complied with the balance billing requirements for COVID-19 inpatients. We will assess how bills were calculated for out-of-network patients admitted for COVID-19 treatment, review supporting documentations for compliance, and assess procedural controls and monitoring to ensure compliance with the balance billing requirement.” (“Hospital’s Compliance With the Provider Relief Fund …”)

The number of surprise bills is startling and can occur without patients even realizing that they have an OON provider. Statistics published in November 2021 by ASPE (Assistant Secretary for Planning & Evaluation), Office of Health Policy, reflected that research over the past decade shows that an average of 18% of emergency visits and almost 20% of patients undergoing elective surgery or giving birth that are covered by employer insurance receive at least one surprise bill. Overall results in these studies reflected more than $1,200 for anesthesia, $2,600 for surgical assistants, and $750 for childbirth. It is estimated that more than 50% of U.S. healthcare consumers with insurance have received an unexpected large medical bill. Can you imagine your customer experience rating when approximately 50% of your patients were surprised with a high medical bill they did not expect?

Do you know what your patients already know?

On January 3, 2022, CMS released a publication, “No Surprises: Understand your rights against surprise medical bills“. For the first time, patients with health insurance through an employer, marketplace, individual plan, or patients who choose not to use their insurance, are protected by the new rules under the No Surprises Act. The CMS publication information includes four key points that the new rule covers:

1. Bans surprise bills for most emergency services (without approval or prior authorization)

2. Bans out-of-network cost sharing (co-insurance, co-payments). You cannot be charged more than in-network for emergency and some non-emergency services

3. Bans OON and balance bills for certain additional services (e.g., OON providers as part of patient’s visit to an in-network facility)

4. Requires that health care providers/facilities provide an easy-to-understand notice explaining the applicable billing protections, who to contact, and consent to receive notice and consent to balance billing by an OON provider

-

- For services provided in 2022, patients can dispute medical bills that are $400 or higher than the Good Faith Estimate

- For self-pay patients who do not have health insurance or choose not to use it, the good faith estimate is applicable.

As described in the Final Rule issued on October 7, 2021, the patient is being removed from the payment dispute between the payer and the provider as defined in the framework for dispute resolution with IDR (independent dispute resolution). If the parties do not reach an agreement on the OON rate by the end of the 30-business-day open negotiation period, either party can initiate the Federal IDR Process.

Penalties for non-compliance with violations of the surprise billing rules can be charged up to $10,000 per violation. Individual states may also impose other obligations. Important to note, states are charged with enforcing the federal requirements on providers, but the federal government will step in if the state declines.

Turning the new regulations into opportunities

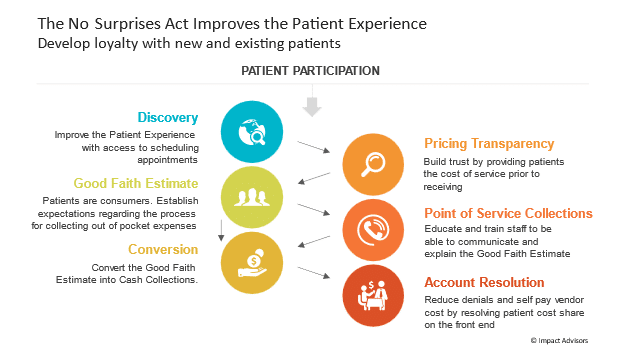

Improving the patient experience is so important, many providers celebrate with National Patient Recognition Week, which usually occurs the first week of February and focuses on clinical care. Treating the financial needs of patients also is important and can overshadow good clinical care when the last interaction the patient has is a dispute due to a surprise bill. Revenue Cycle processes can mitigate the risk of surprise billing and support efforts to improve the patient experience:

- Take time with each patient/guarantor

- Listen to the financial needs

- Become an advocate for the patient

- Commit to going the extra mile

Demonstrating to patients that you care and are committed to them will improve the patient experience. The chart below demonstrates key steps to consider as you begin to implement or revise revenue cycle processes in order to comply with the No Surprises Act.

“No Surprises!” is always the best policy. The following checklist is not all-inclusive, but provides steps to support your path to being the best you can be in Improving the Patient Experience with the revenue cycle team:

1. Determine if surprise medical billing applies to your group practice or physicians

2. Determine if clinicians are eligible for the Notice and Consent process

3. Evaluate requirements for Pricing Transparency and Good Faith Estimates

4. Evaluate Notice and Consent procedures and forms

5. Review signage – must publicly post applicable patient protections within the facility and on the website, as applicable

6. Determine if your state(s) have applicable law or participates in an All-Payer Model Agreement with CMS (e.g., Maryland and Vermont). This must be included in signage/publicly posted.

7. Technology/method for providing patient disclosure either in person, mail, or email, as selected by the patient. Disclosure must include the date and time that payment is requested, and if no payment is requested, the date and time claim submitted to insurance.

8. Provide Education and Training that is designed specifically for patient access, customer service representatives, vendors, and others who may need to discuss patient financials/billing calculations and estimates

9. For eligible self-pay/uninsured patients, ensure timelines are in place for governance of the rule. It is the provider’s responsibility to verify if the patient is self-pay/uninsured. For example:

-

- If a patient schedules more than ten business days in advance, the provider has 3 days to issue the estimate

- If a patient schedules 3 days out, the provider has 1 day to issue the estimate

- If a patient schedules less than 3 days out, the provider is not required to issue a self-pay estimate

10. Compliance program that has been revised due to COVID-19

11. Revenue Integrity annual workplan that includes billing audits, specific for COVID inpatients

12. Technology in place /method for providing Good Faith Estimates

13. Process in place for obtaining, storing, and retrieving patient’s consent for balance billing

14. Vendor oversight with compliance for billing patients

In summary, we know there is more to come. If you remember moving from ICD9 to ICD10 coding, it took several years. There were many starts and stops. As with this law, the Insured Good Faith Estimate with an Advanced Beneficiary Explanation of Benefits (AEOB) has been delayed due to stakeholders falling short with the technical infrastructure necessary to carry out the requirement. However, we know eventually it will come. Don’t miss the opportunity to have better communication with your patients and improve their experience because you are waiting on the regulations. In the words of Thomas Edison, “Most people miss opportunity because it is dressed in overalls and looks like work.”