Following Covid safety precautions in 2020, most healthcare providers stopped accepting cash and checks as a form of payment. After navigating the pandemic restrictions, many organizations reverted to pre-Covid collection policies and workflows. However, a few organizations witnessed the benefits of the paperless payment workflows and are embracing the approach enterprise-wide.

Why Cashless?

In addition to eliminating the staffing time necessary to maintain and audit cash drawers, cashless organizations are finding additional savings in reduced deposit preparation and transportation costs. During an initial assessment, an Impact Advisors client found that cash only represented 1% of total patient payments, with POS (point-of-service) checks accounting for only 8% of total patient payments. More importantly, the client found their payment handling costs exceeded $.50 of every $1 collected, which debunks the traditional view that credit card fees make plastic more expensive than cash and checks.

Collection Standards

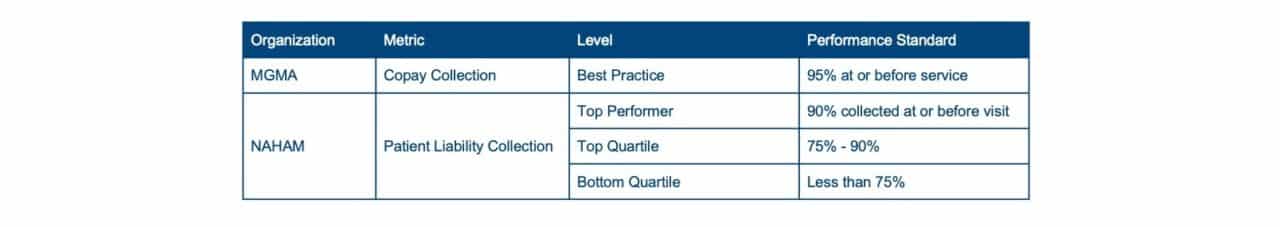

With ever-changing benefit coverages and a growing number of high-deductible plans, having effective POS collection workflows in place is more important than ever. The Medical Group Management Association (MGMA) and the National Association of Health Administration Management (NAHAM) have increased their best practice metrics for the efficient and timely collection of patient out-of-pocket expenses.

NAHAM adjusts their metrics based on the type and urgency of services:

100% elective services deposits prior to service

> 65% IP pt balances prior to discharge

> 50% ER pt-pay balances prior to departure

> 75% Other OP pt-pay balances prior to service

50% outstanding balance

Entry Points and Forms of Payment

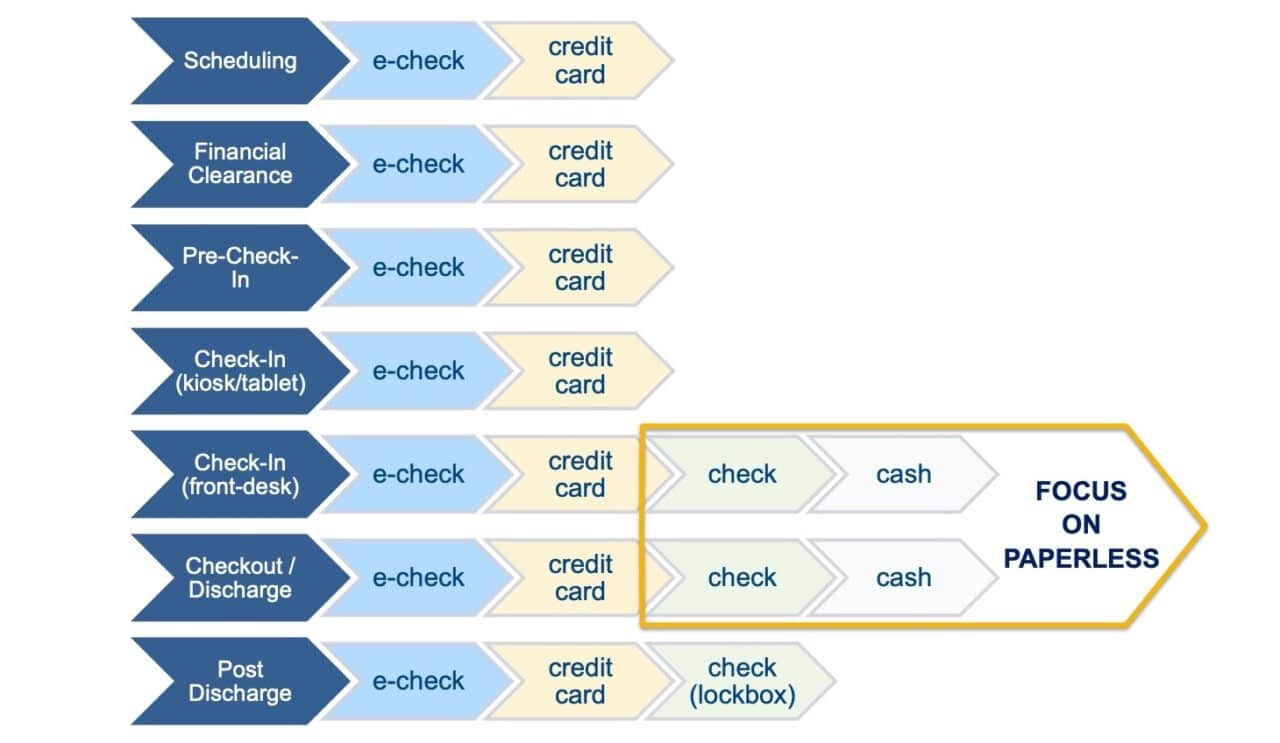

There are multiple points along the patient journey where payments may be initiated. However, the check-in and check-out points of contact account for the vast majority of cash and check transactions. They also represent the most numerous and diverse locations where payments occur. As a result, the POS locations need to be at the heart of the transition to a cashless payment policy.

As patients grow more accustomed to EHR functionality and patient on-line tools (like MyChart), electronic forms of payment are becoming the standard.

Assessing Potential Risks and Benefits

Any policy change with the potential to impact the patient experience requires a thorough assessment. We recommend completing a full current-state point-of-service payment assessment to fully understand the risks and benefits. Key assessments typically include:

- Inventory and assessment of POS collection policies

- Organization compliance level with National Automated Clearing House Association (NACHA)

- POS collection performance metrics

- Department level analysis of payment (% of cash/checks)

- Summary of workflows and associated costs

- Maintaining cash drawer (including daily reconciliation, auditing, loss history)

- Daily deposit creation

- Pick-up/deposit service

- CC merchant fees/costs

- Cash/check posting reconciliation with bank (often a manual process)

- Staff satisfaction

In addition to the cost of staff time, it’s important to consider the staff satisfaction implications of eliminating daily cash drawer and deposit workflows.

An assessment at another recent Impact Advisors client found that cash payments only represented 1% of the client’s total patient payments. Checks accounted for 8% of their total patient payments. However, a single large clinic location accounted for 70% of the check totals.

Planning and Implementing

The initial analysis may make the decision easy for some organizations. However, it’s critical to plan out the change to avoid unexpected pitfalls. Key elements of the program plan should include the following:

Governance

The governance structure should Include leadership representatives from impacted clinical, practice management, patient access, cash management, revenue cycle, finance, treasury, marketing, and patient relations teams. In addition to refining and/or developing a uniform POS collection and deposit policy, the governance team will need to address exemptions to the policy and make necessary scoping decisions on everything from hardware to communication notices. Depending on the size and scope of the organization, a leader from Treasury or Cash Management should be enlisted to lead the initiative, along with an experienced project manager to help develop and execute the project plan.

Defined strategy and roadmap

When establishing a project timeline, consider whether a small or large pilot program is necessary, or whether the program needs to be phased in by type of organization. It’s also important to consider other organization projects and initiatives that overlap impacted departments or locations.

Current state assessment

Although the organization may have a good idea of how the project will go based on the policy and metric assessment, it’s important to collect detailed information from every department and location impacted by the POS collection workflow. In addition to knowing the type and quantity of payments collected, the assessment should include a hardware analysis – including both the device capability and the ownership or lease status of the hardware.

Defined budget and resource needs

In addition to the cost of leadership time and a dedicated project manager, there are often other costs to consider, such as upgrades or updates to: credit card and check scanners and software, EHR and payment portal, and website information related to the organizations payment policies. It is also recommended to invest in printed materials and other forms of communication. The organization’s bank and credit card intermediary play important roles in working through device and upgrade discussions.

Communication and change management plans

One of the most critical elements of the program is the communication component. It is important to communicate to patients across multiple channels to ensure they receive and understand why the organization has made the shift in policy. Reaching the patients prior to their check-in is necessary to avoid surprise, embarrassment, or even the inability to pay.

It is equally important to communicate to the organization’s leadership team and the staff who will carry the new policy forward. The staff also need proper training and scripted messaging to effectively navigate the policy transition.

Lessons Learned

As patients grow more accustomed to EHR functionality and patient on-line tools (like MyChart), electronic forms of payment are becoming the standard. In ten years, the transition to cashless workflows will seem a non-issue. However, it’s important to remember that patients often experience fear and stress when visiting healthcare providers. It is critical to make this transition smooth and transparent to avoid negatively impacting the patient experience. Patients who are willing to pay by cash or check at POS have a high propensity to pay their balances. This effort is about changing patient mindsets on the form of payment.

Even with the most thorough planning and communication there will be challenges along the way. Common issues to expect when adopting a cashless point-of-service check-in include:

Some patient populations will insist on paying by cash or checks. One recent client with hospitals and clinics in high Amish populated counties agreed to accept cash and checks for that population.

Establish policies and workflow for cash and check exceptions.

Establish thresholds for cash and check acceptance when no other means is available.

Establish thresholds and revised timeframe to optimize cash drawer balancing and deposit pick-up. This can impact cash reconciliation processes and should include close oversight by cash management and treasury leaders.

The transition will not occur overnight. Some departments will be slow to adopt the new policy. Continuous monitoring and enforcement are required until the new standards become routine.

If your organization needs more information on navigating to a cashless point-of-service policy, please reach out to us for more information.